Debund | A Study on Tax related Crimes of Entrepreneurs in the Yangtze River Delta -- An Empirical Analysis Based on Judicial Cases

According to China Business News, recently, the Inspection Bureau of Shanghai Municipal Taxation Bureau and the Economic Investigation Team of Shanghai Municipal Public Security Bureau cracked a major crime of falsely issuing VAT invoices, which totaled nearly 6 billion yuan, involving more than 40 enterprises that received such bills, and many of their direct leaders were detained for criminal offences. Crimes in the tax related field have always been a high incidence of crimes committed by small and medium-sized private enterprises. In the criminal cases of tax related crimes committed by units, most of the natural persons who actually control the enterprises are directly investigated for criminal responsibility.

Tax related criminal charges focus on falsely issuing additional bills and tax evasion

There are 12 tax related crimes in China's Criminal Law, which are divided into tax evasion crimes and invoice related crimes. Through judicial document retrieval, among the 12 charges, nearly 90% of the tax related cases are concentrated in the crime of falsely issuing special VAT invoices and the crime of tax evasion. The author used the "Alpha" judicial case database to query: from January 2011 to August 2022, there were 1527 tax related criminal cases of entrepreneurs in the Yangtze River Delta region (Zhejiang, Jiangsu, Anhui, and Shanghai). The Yangtze River Delta is one of the most developed regions in China, which has a significant impact on China's economic development. This paper hopes to reflect the basic status quo of entrepreneurs' tax related crimes in the Yangtze River Delta, reveal the legal risks of entrepreneurs' tax related crimes, and put forward relevant risk prevention and control suggestions through the following analysis and research of more than 10 years of relevant cases, so as to provide reference for effective prevention of entrepreneurs' tax related crimes.

This paper only studies the behavior of entrepreneurs accepting others to falsely issue special VAT invoices for their own units for tax related purposes such as VAT deduction in business activities, excluding the behavior of enterprises falsely issuing special VAT invoices for others. Therefore, such enterprises are usually set up specifically to obtain illegal interests, which is not within the scope of this paper.

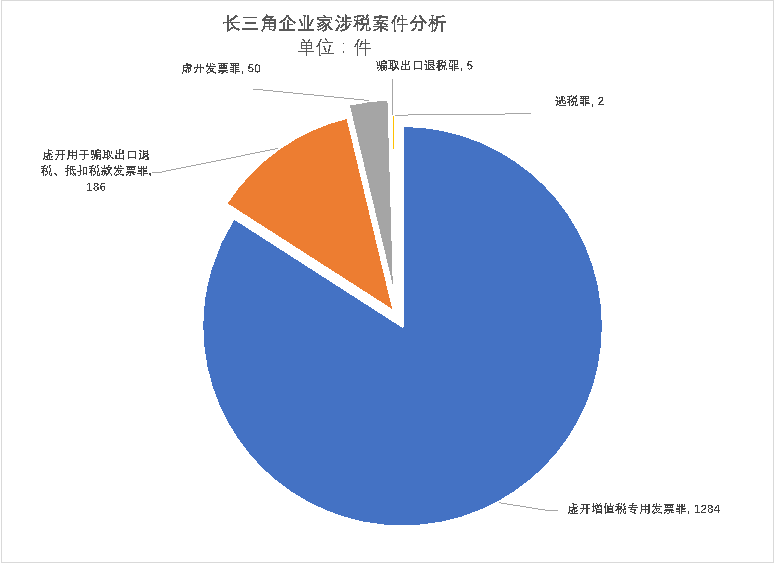

(一) Distribution of charges

From January 2011 to August 2022, out of a total of 1527 tax related criminal cases committed by entrepreneurs in the Yangtze River Delta, 1284 were guilty of falsely issuing special VAT invoices, accounting for 84%; 186 cases involving the crime of falsely issuing invoices used to defraud export tax rebates and offset taxes, accounting for 12%; There were 50 cases involving the crime of falsely developing tickets, accounting for 3%; 5 cases of defrauding export tax refund, accounting for 0.3%; There were only 2 cases involving tax evasion, accounting for 0.1%.

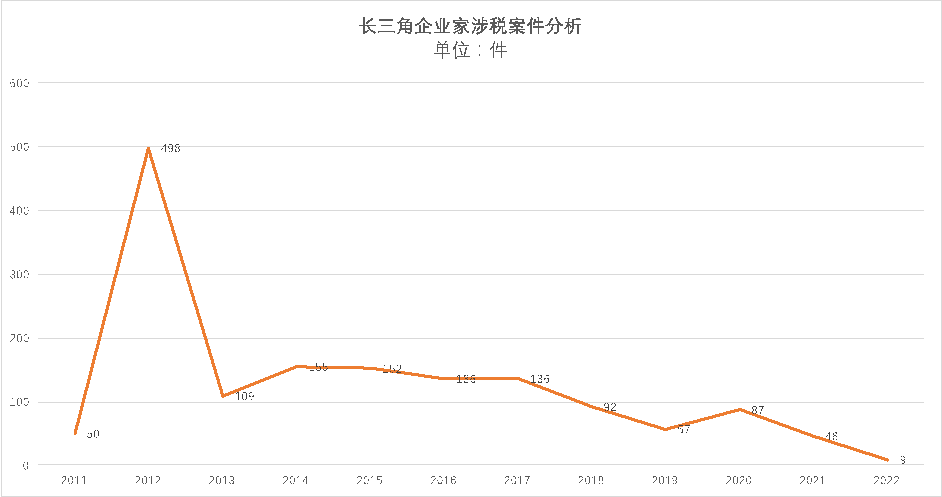

(二) Annual trends

As shown in the figure below, the overall trend is annual decline.

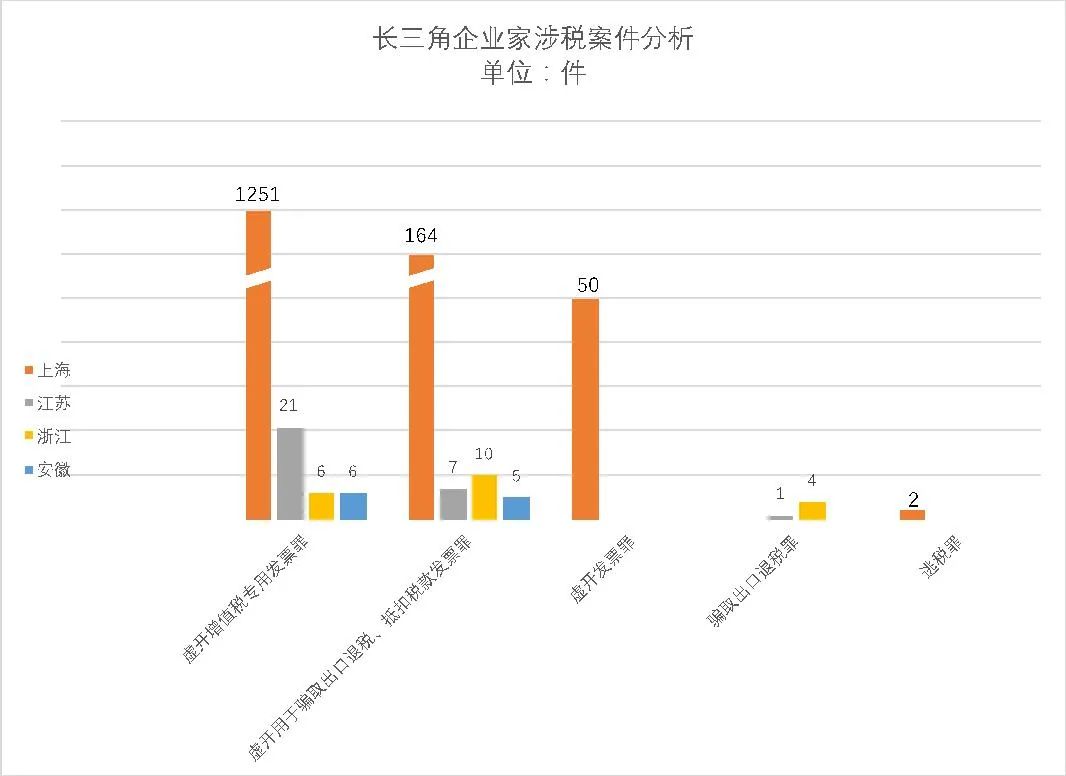

(三) Geographical distribution

From January 2011 to August 2022, among the 1527 tax related criminal cases of entrepreneurs in the Yangtze River Delta, 1467 occurred in Shanghai; 29 cases occurred in Jiangsu; 20 cases occurred in Zhejiang; Eleven cases occurred in Anhui.

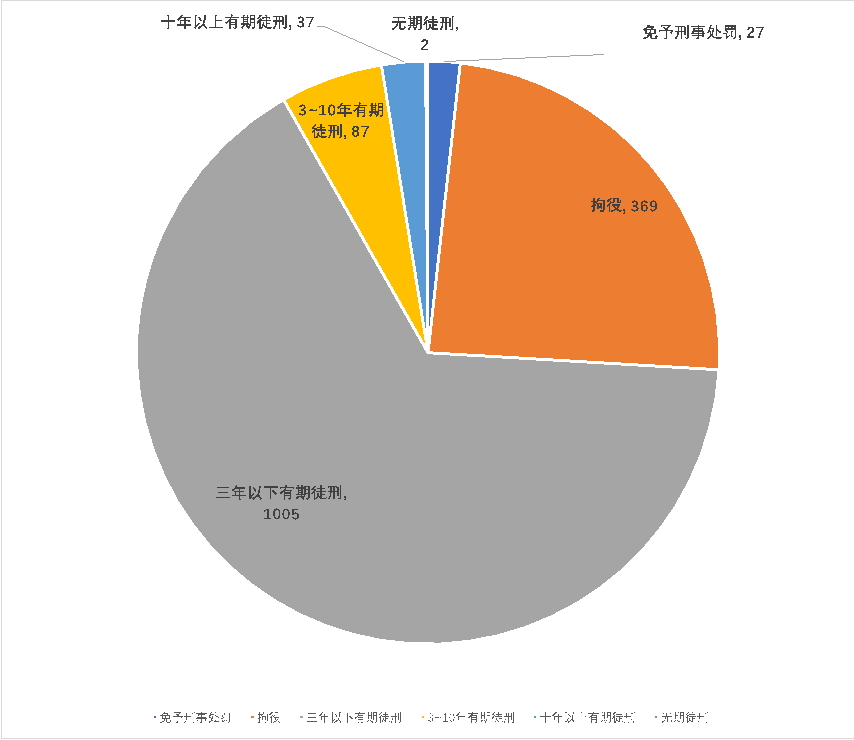

(四) Term of imprisonment

From January 2011 to August 2022, out of a total of 1527 tax related criminal cases committed by entrepreneurs in the Yangtze River Delta, 2 were sentenced to life imprisonment, 1129 were sentenced to fixed-term imprisonment (1005 for less than three years), 369 were detained, and 27 were exempted from criminal punishment. There were 1339 suspended sentences. After studying the relevant judgments, it was further found that basically those sentenced to criminal detention and those sentenced to less than three years could be suspended at the same time.

The above data show that it is very difficult to plead innocence when the tax related cases enter the trial stage.

An analysis of the causes of tax related crimes

(一) China's overall tax burden is on the high side

The data shows that the current macro tax rate of developed countries is about 33.4%, the average macro tax rate of developing countries is about 17.0%, and the average macro tax rate of all countries is about 21.8%. In 2017, China's macro tax burden was 19.2% higher than the average level of developing countries, which was equivalent to the average level of developed countries. This does not match the identity of China as a developing country.

Take a limited liability company as an example. In actual operation, not only 3% - 13% value-added tax should be paid, but also 25% corporate income tax should be paid. After tax profits should be distributed to individual shareholders, but also 20% personal income tax should be paid. In this way, nearly 50% of corporate profits become taxes. Facing the heavy tax burden, some enterprises purchase invoices without real transactions to reduce the actual tax burden.

(二) Some enterprises have real transactions and cannot obtain bills

In the production and processing of agricultural and sideline products, the purchase and utilization of waste materials, the purchase and sale of bulk commodities (such as coal, steel, electrolytic copper, gold), construction projects, medicine and other industries and fields, due to some special reasons, there are enterprises that can not obtain compliance notes for entry, offset costs or settlement payments, even though they have real business, so there is the phenomenon of purchasing invoices by illegal means.

(三) Cognitive biases

The tax related charges stipulated in the criminal law of our country are the criminal liability for a series of prohibited acts against enterprises and enterprise personnel, aiming to strengthen the criminal rule of law for the market economy. In the eyes of entrepreneurs with strong economic awareness, risks and benefits go hand in hand. Risks may bring unexpected losses to enterprises and may also bring special benefits. Among all kinds of risks faced, entrepreneurs have relatively strong cognitive ability to commercial risks. They also have certain cognitive ability to civil and commercial legal risks in legal risks due to their relatively high attention, but their cognitive ability to criminal risks is very insufficient. For example, with regard to the crime of "falsely issuing special VAT invoices", some entrepreneurs mistakenly believed that it would not constitute a crime to ask others to issue special VAT invoices on their behalf. Even if they were inspected by the tax authorities, they were just making up tax.

Why is the proportion of tax related crimes in Shanghai so high?

As mentioned above, of the 1527 tax related cases of entrepreneurs in the Yangtze River Delta, 1467 occurred in Shanghai, 29 in Jiangsu, 20 in Zhejiang and 11 in Anhui. Of the 1284 cases of false VAT invoices, 1251 occurred in Shanghai, 21 in Jiangsu, 6 in Zhejiang and 6 in Anhui.

Zhejiang and southern Jiangsu are the most developed areas of China's private economy. It is reasonable to say that crimes do not divide regions. In theory, the purchase of VAT invoices will not be concentrated in Shanghai. The author judges that the possible reason for this abnormal data is that Jiangsu and Zhejiang have better tax environment.

In recent years, the author has visited a number of private enterprises in Jiangsu and Zhejiang to do research. During the research, it was found that although these enterprises also implemented the mode of audit and collection, there were a large number of white notes in the financial vouchers to offset the cost, and the year-end tax settlement did not adjust the amount of tax income. Ask the reason, what should the tax authorities do if they check? Answer: On the surface, it is an audit levy, but in essence, it is an approved levy. Even the turnover tax such as value-added tax can be negotiated as a fixed amount. In this way, in fact, the local tax authorities acquiesced in the use of IOUs to offset costs, so that enterprises have no incentive to purchase invoices to offset costs. This is unimaginable in Shanghai.

How to prevent the risk of tax related crimes

Faced with the high tax burden of enterprises, enterprises actually have many tools to use, such as additional deduction of R&D expenses, recognition of high-tech enterprises, accelerated depreciation of fixed assets, VAT reduction through the establishment of small and micro enterprises, full use of the proportion of bad debt reserves, pricing transfer, and the establishment of operational institutions in tax depressions or areas with relatively loose tax burden environment. It is a simple and crude method to reduce the actual tax burden by purchasing special VAT invoices. Especially in the years when the epidemic did not end, leading to financial shortage, and the launch of the fourth phase of Golden Tax, entrepreneurs should be more vigilant.

On the other hand, from the data point of view, there are no acquittals among the cases prosecuted by the prosecution. In other words, as long as the prosecution has filed a public prosecution, the probability of being convicted is extremely high. Therefore, once encountering tax related cases, we should try every means to block them through legal and compliant measures in the police investigation stage or the prosecution review stage, and strive for the cancellation of the case by the police or the prosecutor's decision not to prosecute. Otherwise, once being prosecuted, the consequences will be serious.

沪公网安备 31010602001694号

沪公网安备 31010602001694号